How Pharma Is Connecting Digital Innovation to Physical Products

Digital innovation is helping pharmaceutical companies meet rising customer demand while generating billions of dollars in value to tech-savvy market players. Learn about progressive telehealth solutions and Direct-to-Consumer services, and read about some of the leaders in this rapidly expanding space.

Telehealth solutions and Direct-to-Consumer (DTC) services are gaining traction in the pharmaceutical industry at a torrential pace. The COVID-19 health crisis and lockdown accelerated client demand for technology capable of delivering remote health solutions, and pharmaceutical companies that are adapting and developing quickly are seeing tremendous profits as a result.

Pharmaceutical companies now recognize the need to adopt DTC technology to meet growing customer demand while creating a more modernized sales mechanism that has proven itself to be worth billions to market players that have already invested in the tech.

The emergence of healthtech due to the pandemic

The healthcare industry ran into a sizable challenge during the COVID-19 pandemic: how can medical professionals help people without seeing them in person? To solve this problem, the industry turned to digital innovations such as normalization of online medical consultations, drug prescription platforms, and bots that can advise users about taking medicine. These solutions have gained popularity among consumers, helping establish a new norm for how they receive healthcare.

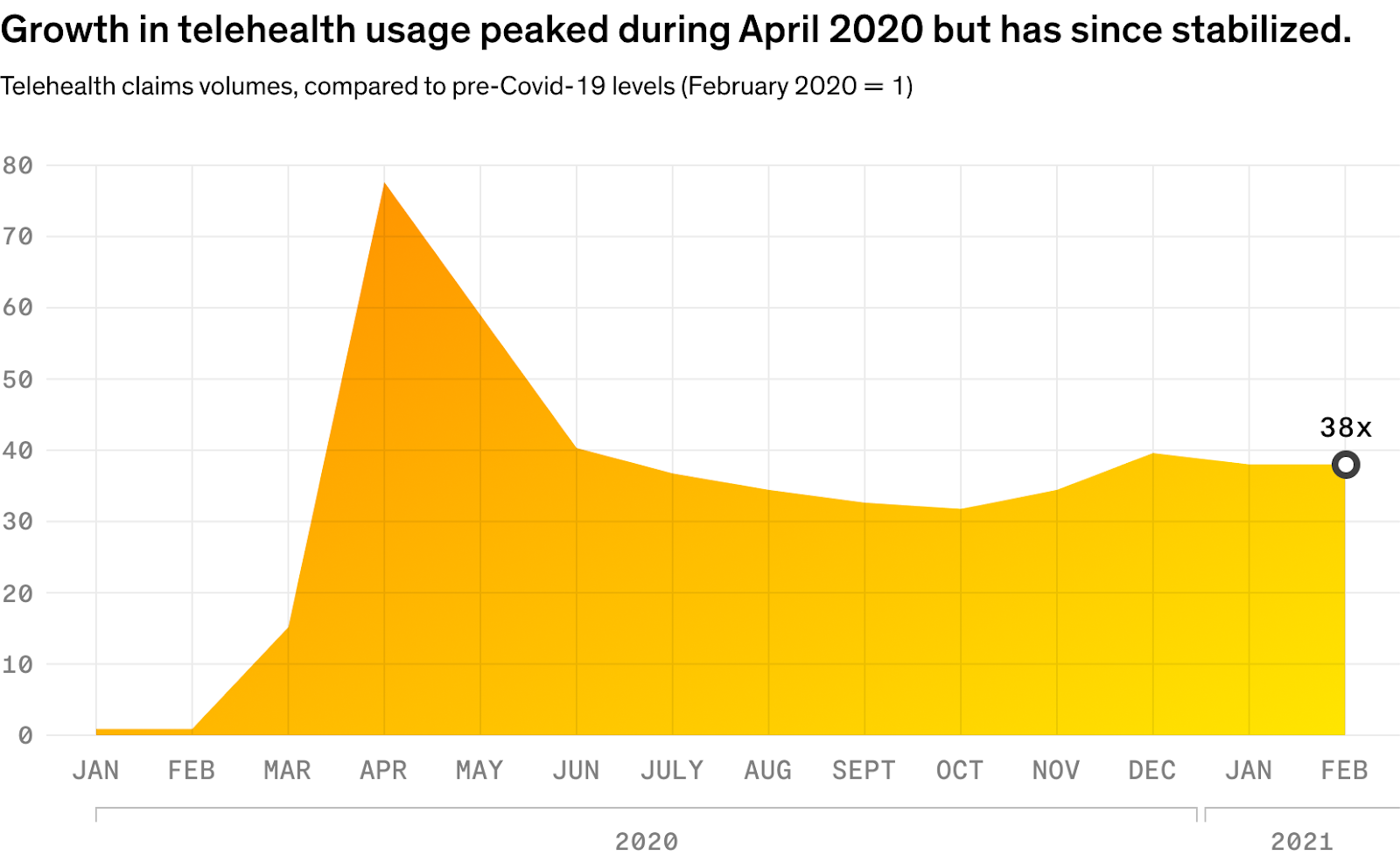

For instance, in February 2021, consumer telehealth usage was an astounding 38x1 higher than it was in February 2020. Also, the 2020 UnitedHealthcare Consumer Sentiment Survey2 found that 56% of Americans were likely to use virtual care for medical services.

Source: McKinsey & Company

Source: McKinsey & Company

Results of the 2020 BCG patient sentiment survey3 also underlined the importance of offering online customer tools, showing that 29% of patients view remote care as an important factor in selecting a provider, and 53% of patients regard remote care options as ‘more important’ following the COVID-19 pandemic.

This move to online care is clearly more than just a fad. Startups in this field are finding tremendous success, while the titans of big pharma are making huge investments in DTC tech in hopes of capturing a greater share of this lucrative, rapidly expanding market.

The meteoric rise of DTC telehealth startups

DTC pharmaceutical telehealth is now firmly established as a multi-billion dollar industry. Ro, a relative newcomer founded in 2017, has grabbed a foothold as an online pharmaceutical sales giant. The company offers virtual solutions across several tiers, selling medicine for men through its platform Roman, products to help people quit smoking on its Zero platform, and medicine for women through its platform Rory.

Ro has launched several successful online pharmaceutical platforms. Source: Ro

Ro has launched several successful online pharmaceutical platforms. Source: Ro

These platforms all work simply enough for users. After filling out a virtual "office visit" form online, a doctor reviews the information and sets up a phone call, video call, or chat, depending on the patient's local regulations. The doctor then recommends a course of treatment—either over-the-counter or prescription— and the user makes a purchase that is discreetly mailed to them through Ro.

Patients also get unlimited messaging with their online physician free of charge, as well as access to the site's educational library and Facebook-based support community.

Pfizer saw the potential in Ro’s online sales platform and offered to partner with the startup in October of 2020.This alliance gave Pfizer direct access to Ro users with cholesterol- and hypertension-related conditions—a vast accessible market for Pfizer’s generics arm—while Ro further established its position as a viable telehealth-enabled contender in men's sexual health and cardiovascular treatment.

Ro’s online prescription sales platform and partnership with Pfizer have proven to be lucrative. In March of 2021, the 3.5 year old startup received $500 million in Series D funding4 and an evaluation of $5 billion.

Big pharma keeps investing in online tech

To extend its online expansion, Pfizer has also partnered with healthtech company Catalia Health. In September 2019, the two companies launched a year-long pilot scheme exploring how patients engage with robot companions that use artificial intelligence (AI) to check on symptom management and assist with medication adherence.

Catalia Health created Mabu, a home robot that coaches patients on health and prescription drugs. Mabu uses voice interactions powered by conversational AI to assess a user’s mood, record data, manage symptoms, and provide helpful information.

The robot then supplies information to medical professionals, such as the frequency of the customer’s medication usage, or any user questions the robot is unable to answer. This process helps ensure that patients take their medication and can more easily adjust to any drastic lifestyle changes resulting from an illness or a disorder. This solution can help patients stay healthy and offers pharmaceutical companies a tool that can increase their viability and connectivity with their customers.

Catalia Health is one of Sean Sheppard’s (Managing Partner of U+ Americas) portfolio companies. Catalia’s healthtech development funding totals $7.75 million.

Catalia Health is one of Sean Sheppard’s (Managing Partner of U+ Americas) portfolio companies. Catalia’s healthtech development funding totals $7.75 million.

Procter and Gamble also decided to invest in DTC online healthcare, launching Kindra in November of 2019. The platform offers a wide range of pharmaceutical products that focus on treating menopause symptoms. The site offers tailored solutions based on information clients provide through an interactive quiz, as well as virtual assistance to engage with customer requests and orders.

Procter and Gamble’s investment in this specific demographic of healthcare underlines both the potential and the confidence that large pharmaceutical companies have in the online sector.

Building an end-to-end solution around digital healthcare

The digitalization of healthcare has presented an opportunity for pharma companies to build an end-to-end solution that captures extra segments of the traditional value chain.

This system would encompass the whole complex—including telehealth, distribution, prescriptions, digital marketing, digital experiences, partnerships, and omnichannel capabilities—all handled by the same pharma company.

To create this end-to-end offering, pharma companies need to combine new e-commerce solutions, digital marketing platforms, and backend tools with the right mindset, skillset, and execution framework.

Companies that choose this path will be able to tie together the entire pharma value chain and reap the benefits of increased margins, a more insightful understanding of patient data, and clear channel advantages over competitors that stick with the manufacture-only model.

How can U+ help your company become a leader in innovation?

U+ is a global digital innovation firm with 12 years of experience and an 90-person-strong in-house team. Our team has built two corporate innovation labs, exited three companies, invested in 140+ startups, and generated over $1B in market value. The U+ Method can help your company take full advantage of the digitalization of the healthcare sector by innovating at scale.

To date, we have brought 90+ successful businesses to market, creating over $1 billion in new value for Fortune 1000 companies, including several businesses in the healthcare industry. Our success stories in this space include an Online Fertility Wiki for an IVF Clinic and a Wellness App Platform for Sodexo.

Footnotes

-

Oleg Bestsennyy et al., Telehealth: A quarter-trillion-dollar post-COVID-19 reality? ↩

-

United Healthcare, 2020 UnitedHealthcare Consumer Sentiment Survey ↩

-

Alex Baxter et al, The End-to-End E-Commerce Opportunity for Pharma ↩

-

Katie Jennings, Digital Health Startup Ro Raised $500 Million At $5 Billion Valuation ↩