Baby Boomers: A Bigger Digital Market Than You Might Think

Baby Boomers are a lot more tech-savvy than you might think. Let’s explore how the wealthiest living generation interacts with technology, particularly when it comes to healthcare.

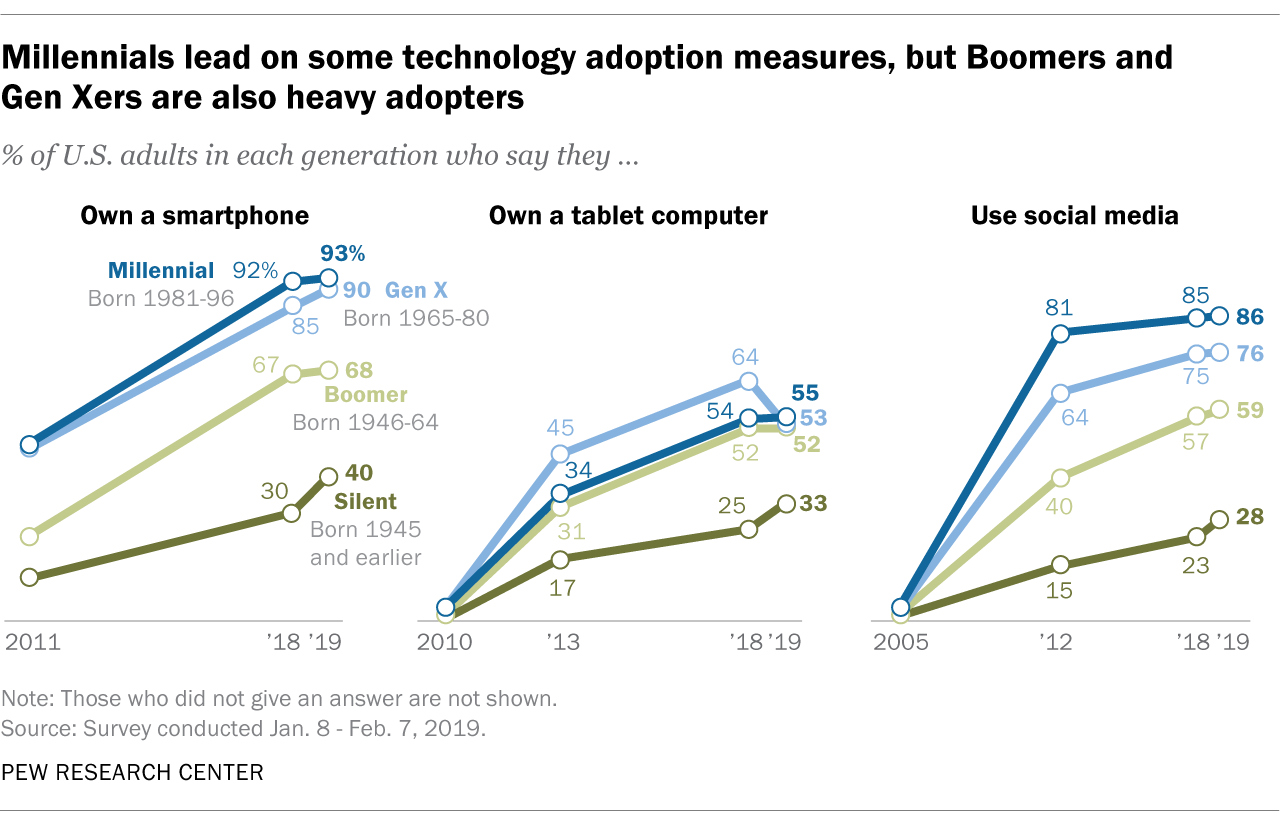

Of the many popular myths and misconceptions about Baby Boomers, perhaps the most inaccurate is the claim that digital technology is alien to the generation born between 1946 and 1964. On the contrary, Boomers have been embracing technology at a rapid pace. Only 25% of them owned smartphones in 2011; today, that figure is closer to 70%1. Even social media usage among Boomers has risen by 10% over the past decade. This is a far more tech-savvy generation than the popular narrative might lead you to believe.

Business leaders would be well-advised to update their views about how Baby Boomers interact with technology. Millennials and Gen Z consumers may be driving marketing trends across the tech space, but Boomers are the ones with the money. In the US, roughly 70% of all disposable household income2 belongs to the older generation. With an annual spend of half a trillion dollars3 (an ever-growing share of which is moving online4), Boomers remain by far the most significant generational demographic by purchasing power.

As Boomers age, however, their relationship with technology will change. The entire generation will be over 65 years old by 2030; this will have implications throughout the technology sector, with the biggest changes set to occur in the healthcare space.

How much are Baby Boomers using new technologies?

Baby Boomers use technology at a similar rate to the rest of the population. A recent Pew Research report revealed that 9 out of 10 Boomers use technology for everyday tasks like paying bills and executing transactions. According to the same report, over 70% of them engage with social media platforms.

As we’ve seen, most Boomers own and use smartphones on a regular basis. At the same time, tablets are as popular with Boomers as they are with any other generation: The Pew Research report found that 52% of them owned tablets, roughly the same rate as Millennials (53%)5.

However, Baby Boomers differ from younger cohorts in how they interact with their devices. Forbes has reported that the generation raised on magazines and television prefers a simple user interface that allows them to learn and adapt at a slower pace relative to their children and grandchildren6. The article recommends a user experience that incorporates “straightforward text and facts”, easy-to-navigate designs, and a renewed focus on voice-activated search functions. The latter solution will grow in importance as older Boomers look to overcome health issues such as reduced mobility and failing eyesight.

Do Baby Boomers want to interact with healthcare systems digitally?

The COVID-19 pandemic represents not only a crucial moment for digital acceleration in the healthcare industry but also a key turning point in how Boomers think about their interactions with healthcare systems, tools, and providers.

One of the biggest developments we’ve seen since the onset of the pandemic is the generation’s widespread rejection of senior housing, retirement homes, and other long-term care facilities in favour of home care. According to the aforementioned Forbes article, 82% of Boomers said they would prefer to stay at home “even after they need daily assistance”—a phenomenon known as “aging in place.”

These preferences are already showing up in the relevant data. In the third quarter of 2020, senior housing occupancy fell to a record low—an unsurprising figure in the context of a public health crisis and associated government restrictions on visitations. But restrictions are only one side of the story: NIC Chief Economist Beth Burnham Mace has said the bigger threat to occupancy is a shift in attitudes among consumers and patients.

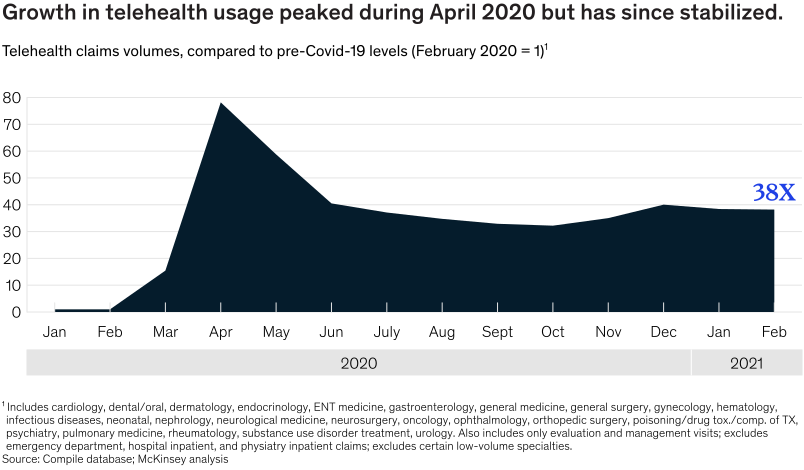

With a continuously growing number of Baby Boomers opting to avoid the traditional healthcare system, organizations that offer telehealth alternatives stand to reap huge benefits. Healthcare providers that have digitalized the user experience have already won big over the past 18 months. A McKinsey study on telehealth adoption, conducted in the summer of 2021, appears to confirm this fact (see chart below). According to the data, telehealth usage peaked in April 2020, but even the more modest current figure represents a staggering 38x increase in usage since before the pandemic7.

As an industry, telehealth is clearly thriving. But there are still many obstacles to overcome before it can fully meet the needs of the older generations that rely on the technology the most. For instance, a University of Michigan poll from October 20208 found that:

- 75% of telehealth providers are unable to conduct a physical examination.

- 67% of providers see a reduction in quality of care when interacting with patients remotely.

- 25% of patients between 50 and 80 years old report basic quality issues with remote appointments, including poor sound quality.

- 24% of patients from the same cohort express privacy concerns.

What should providers do to promote telehealth adoption?

As with any relatively recent innovation, telehealth is fundamentally incomplete in many ways. The University of Michigan poll referenced above highlights some of the pain points in existing services as experienced by patients and providers alike. While this indicates a widespread desire for better, safer, and more efficient digital healthcare solutions, it should not be interpreted as a rejection of telehealth per se. According to the McKinsey survey, 40% of consumers believe they will continue to use telehealth going forward (up from 11% pre-COVID) while venture capitalist investment in the space has reportedly tripled since 2017.

Providers can take several actions to hasten digital healthcare adoption among Baby Boomers. Perhaps the key breakthrough will involve raising awareness about the full range of care options a virtual health package can offer. Telehealth means more than simply reducing or eliminating in-person medical appointments. For instance, wearable technology and behavioral health offerings are empowering older generations to reassert control over their lifestyles, diets, and exercise regimes. On the healthcare provider side, improvements in analytics and scheduling are making these services ever more streamlined and efficient.

Meanwhile, high-quality care has never been more accessible, especially to older and less mobile consumers. The United States, for example, has significant regional gaps in treatment capacity. 56% of U.S. counties are entirely without psychiatrists9. Digital health tools solve this basic problem of access by providing online services on demand, so all a patient needs is an internet connection. In parallel, the so-called ‘digital divide’ between communities with easy internet access and those without such access continues to narrow, further eliminating barriers to adoption.

Looking ahead, we can conclude that providers who wish to develop a successful digital health strategy for Baby Boomers should do these three things:

- Invest in secure, robust and latency-optimized systems.

- Support the underlying technology with simple, intuitive, and consistent user interfaces.

- Launch long-term awareness campaigns aimed at clarifying what telehealth is, explaining why it matters, and showcasing the indisputable benefits on offer to those who make the leap.

How can U+ help your healthcare company become a leader in innovation?

U+ is a global digital innovation firm with 12 years of experience and an 85-person-strong in-house team. To date, our team has built two corporate innovation labs, exited three companies, invested in 140+ startups, and generated over $1B in market value. The U+ Method can help your company take full advantage of the digitalization of the healthcare sector by innovating at scale.

We have launched U+Health in partnership with Healthcare Business Resources, a private equity group focused on transforming healthcare and a team of experienced Healthcare Industry veterans with over 185 years of combined operational and M&A experience of $26B+ in transactions.

Don’t hesitate to get in touch.

Notes

Footnotes

-

Pew Research, US Generations Technology Use ↩

-

Forbes, The Misconception Of Baby Boomers And The Age Of Technology, 2019 ↩

-

Epsilon Report, Preferences and Behaviors Across Generations, 2019 ↩

-

Visa Report, Baby boomers still outspend millennials ↩

-

Pew Research, US Generations Technology Use ↩

-

Forbes, How Digital Health Tools Can Save You Money And Save Your Life ↩

-

McKinsey, Growth of Telehealth Report ↩

-

Age In Place Tech, Technology For Aging Report ↩

-

McKinsey, US Behavioral Health Crisis During The COVID-19 Pandemic ↩